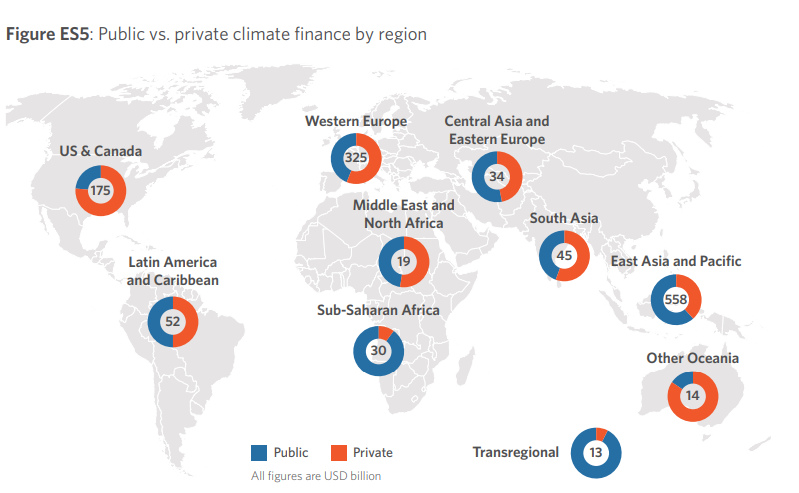

Climate investments in the African region are primarily driven by public funds. From the graph developed by the Climate Policy Initiative, access to private capital is low in Africa and high in the other regions of the world. Achieving the transition to net-zero emissions by 2050 requires substantial climate mitigation investment in low and middle-income countries which will need about $1 trillion annually by 2030 to reach that ambitious goal, according to the International Energy Agency, with the majority of that funding flowing into the energy industry.

A report from IMF Projects that growth in public investment, however, will be limited, and that the private sector will therefore need to make a major contribution toward the large climate investment needs for emerging markets and developing economies. The private sector will need to supply about 80 percent of the required investment.

How African Governments Can Stimulate Private Climate Investment

A number of promising strategies can be pursued by the African region to raise and attract private capital for climate finance:

Creating an investment environment that is favorable to investors means addressing bottlenecks:

- Improving the Business Environment: African governments have been making strides in improving the ease of doing business, taking cues from global benchmarks like the World Bank’s Doing Business indicators. However, the journey towards a more favorable business environment involves continuous reforms. For instance, streamlining bureaucratic processes, reducing administrative hurdles, and enhancing transparency in regulations can significantly lower the barriers for entrepreneurs and investors. Countries like Rwanda and Mauritius have been praised for their efforts in simplifying business procedures and fostering a conducive environment for investment, which has led to increased foreign direct investment (FDI) inflows and economic growth.

- Harnessing Innovative Financing: The challenge of funding sustainable development projects in Africa requires innovative solutions. Green bonds, for example, are financial instruments specifically earmarked for environmentally friendly initiatives. While they are gaining popularity globally, Africa’s share in green bond issuances remains relatively low. However, the potential is significant. For instance, Kenya issued the first sovereign green bond in Africa in 2019, raising funds for renewable energy projects. Additionally, blended finance, which combines public and private sector resources, presents a promising avenue for financing climate projects. The establishment of a repo market, as suggested by the United Nations Economic Commission for Africa (UNECA), could stimulate demand for African green bonds, attracting more investment into the continent’s sustainable development agenda.

- Debt Restructuring for Sustainable Investments: High levels of debt burden many African countries, limiting their ability to invest in crucial sustainable development initiatives. Debt restructuring offers a pathway to alleviate this burden and create fiscal space for green investments. Seychelles provides a notable example of successful debt-for-climate adaptation swaps, where a portion of its debt was exchanged for support in climate resilience projects. In 2018, Seychelles also issued a blue bond, with a partial guarantee from the World Bank, to finance ocean conservation projects. These initiatives not only address environmental challenges but also demonstrate how debt restructuring can catalyze sustainable development.

ENROLL: SOLAR PV DESIGN AND INSTALLATION COURSE

References

World Bank Doing Business Report 2020: https://documents1.worldbank.org/curated/en/688761571934946384/pdf/Doing-Business-2020-Comparing-Business-Regulation-in-190-Economies.pdf

Africa Finance Corporation: Blended Finance Solutions: https://www.blendedfinanceafrica.com/

Climate Policy: Debt-for-Nature Swaps: Exploring the Potential for Climate Mitigation: https://www.imf.org/en/Blogs/Articles/2022/12/14/swapping-debt-for-climate-or-nature-pledges-can-help-fund-resilience

ABOUT THE AUTHOR

Glory Oguegbu is a climate specialist, energy transition entrepreneur, accomplished writer, and published author dedicated to advancing a zero-carbon world. Her mission revolves around promoting climate literacy, advocating for a just energy transition, and actively contributing to the development of renewable energy projects. Through her work, she aims to provide Nigerians with access to clean electricity, playing a pivotal role in sustainable and environmentally friendly energy solutions. Oguegbu’s efforts have been recognized with awards in acknowledgment of her significant contributions to the field.

She’s the founder and CEO of the Renewable Energy Technology Training Institute (RETTI) created to support electricity access which will benefit 93 million Nigerians by training and preparing new solar installers. RETTI has since trained 3000+ engineers who provided electricity for 15, 000 homes/businesses and offset 840, 000 tonnes of C02 through installations. Glory pioneered Climate Smart Nigeria, an ambitious environmental program designed to combat low climate literacy in Africa. Through the CSN, she created Africa’s first contextualized climate education learning toolkits and the Climate Leadership Fellowship.

She regularly shares her insights on these subjects through her BLOG and LINKEDIN articles. Through her writing, Glory contributes to the discourse surrounding climate change, energy sustainability, and the broader implications of the evolving energy landscape.

MORE..

–Climate and Energy Milestones Achieved in 2023

Projects Preparing New Workforce for Energy Transition

–Africa Fellowship for Young Energy Leaders